Market Updates

GPA Weekly Economic Update, December 10, 2018

A Santa rally is being derailed by escalating fears of a trade war with China and a global growth slowdown. Stock investors ran for the hills this week, sending prices sharply lower amid heightened volatility.

The wild gyrations in the financial markets belie the steady drumbeat of consistency in the economy. Growth is slowing as expected, raising hopes that the Fed is successfully engineering a soft landing, but not falling off a cliff. Manufacturing activity is holding up well amid trade tensions and the service sector is still thriving.

Importantly, the most tangible barometer of the economy’s performance, the job market, remains on a healthy path.

The increase in nonfarm payrolls came in weaker than expected in November but was still solid and exceeded growth in the working-age population. Growth in worker earnings held steady at cycle highs, and more of the benefits are trickling down to lower-paying jobs. The financial markets are pricing in lower odds of future rate hikes, but the Fed is still expected to raise short-term rates at the upcoming meeting on December 18-19.

WEEKLY ECONOMIC COMMENTARY – WEEK OF December 7, 2018

The Santa rally, if it comes, might have to wait until the trade Grinch leaves town. So far, it shows no sign of departing and the door may not open for as long as 90 days, which is the deadline for negotiating an exit strategy agreed to last weekend. That makes for an interesting, and potentially explosive, the month of March, when the possibility that two “no deals” involving Brexit and a U.S/China trade accord could potentially blow up the place. If it takes that long for a deal to be worked out, be prepared for a rocky ride in the financial markets as twists and turns in negotiations will light up the twitter feed and hammer investor psychology. We always knew the Ides of March would come back to haunt us.

Slowing Global Growth

To be sure, the markets have not been a model of tranquility in recent months. Since October 10, two weeks after the Trump administration imposed 10 % tariffs on $200 billion of Chinese imports, the CBOE Volatility Index, or VIX, has surged to an average of 20 compared to about 13 over the previous five months. In fact, the index reached or exceeded 20 fully half of the 40 trading days during the period, a mark that was not reached in even one trading day throughout 2017. The “Wall of Worry” on Wall Street, of course, is not confined to just trade matters. Slowing

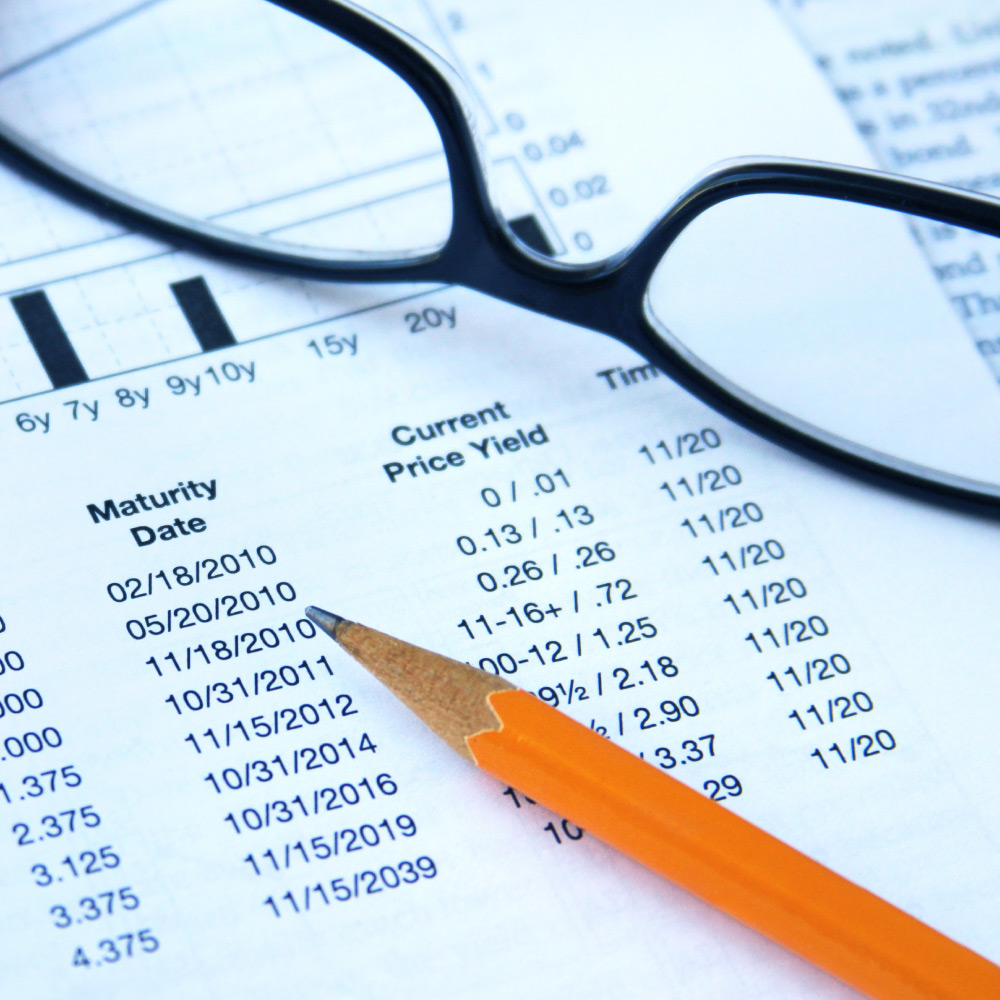

global growth, rising interest rates, a flattening yield curve, falling oil prices and uncertainty over monetary policy have all contributed to investor anxiety. None of these unsettling influences was erased during the latest trading week.